child tax credit monthly payments continue in 2022

The benefit is set to revert because. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Inflation Defined Why Costs Proceed To Rise And Who S To Blame Alishop123 High Quality Free Shipping Order Now In 2022 Blame Developed Nation Historical Context

Families who received monthly payments in the second half of last year can still get up to 1800 for children younger than 6 and 1500 for children ages 6 to 17 as part of their refund.

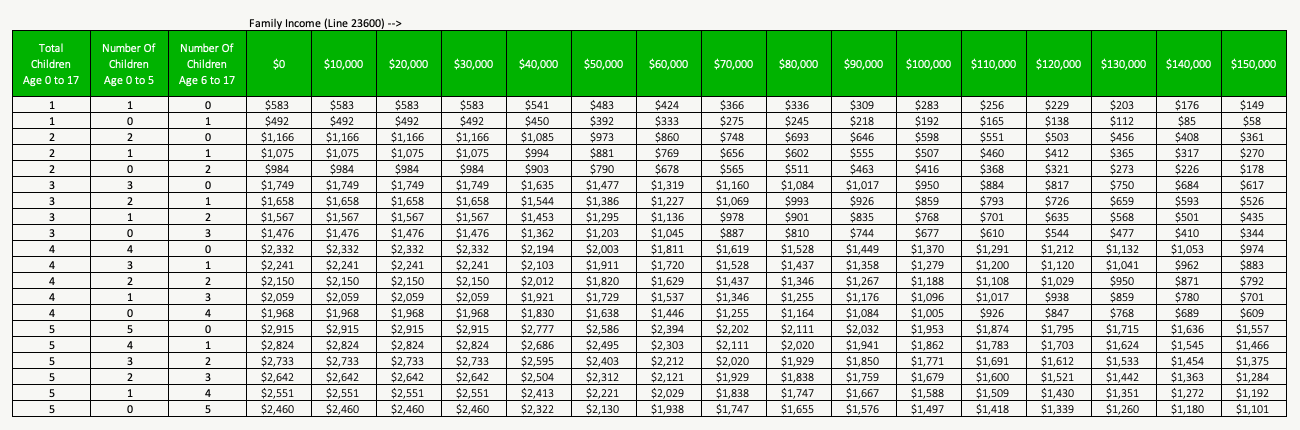

. This credit begins to phase down to 2000 per child. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. In total itd cover 35 million householdsor 90 of those with.

And although the monthly payments have expired eligible. With six advance monthly child tax credit checks sent out last year only one payment is left. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your taxes in 2022.

In addition to reviving the tax credit payments for 2022 bidens stalled build back better bill would. The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To 900 Could Be Sent Out.

Making the credit fully refundable. The CTC will also revert to its prior much smaller amount and only claimable in your annual tax filing as was the case in previous years. It changed the structure to a monthly stipend instead of an annual lump sum.

Most payments are being made by direct deposit. Do take note from July to December the federal government has been giving eligible parents as much as 3600 per year for a child under the age of six and up to 3000 for children between ages six and seventeen. However parents might receive one more big payment in April 2022 as part of last years plan.

7 2022 200 pm. The bill signed into law by President Joe Biden increased the Child Tax Credit from 2000 to up to 3600 and allowed families the option to receive 50 of their 2021 child tax credit in the form. Those who opted out of all.

Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. You see monthly payments started arriving. In December 2021 Congress failed to pass the Build Back Better Act which would have extended the monthly CTC payments for one more year.

Families who are eligible for the expanded credit may see more money come to them when they file their taxes this year as just half of the total child tax credit was sent via monthly payments. Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. Given this credit is just one of many items under review withing the BBB it could take a while to see payments in 2022.

1 Child tax credit payments will continue to go out in 2022 This final batch of advance monthly payments for 2021 totaling about 16 billion was sent to more than 36million families across the country. The payments wont continue in 2022 for the new year. Half of the credit -.

Those who opted out of all. That includes the late payment of advance payments from July. The advance child tax credit received from july through december last year amounted to up to 1500 or up to 1800 for each child depending on the childs age.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The benefit is set to revert because. Therefore child tax credit payments will not continue in 2022.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. There would be some differences between the 2021 child tax credit payments and 2022 payments if the current version of the Build Back Better Act is. If signed into law the White House says the bill would mean the 250 and 300 monthly payments would go out monthly in 2022.

This final installment which. The plan raised the existing child tax credit from 2000 to up to 3600 per child for ages 5 and younger and 3000 for each child aged 6-17. As of right now the 2022 child tax credit which you would get when you file in 2023 is set to go back to 2000 for each dependent age 17 or younger.

Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. There may even be the possibility that no monthly payments if the bill is not passed. This all means that a 250 or a 300 payment for each child has been direct deposited each month.

More payments will go out in the new year according to the Internal Revenue Service. Those who opted out of all.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Is Expanded Child Tax Credit Dead Did It Help Deseret News

Child Tax Credit 2022 Monthly Payment Still Uncertain Abc10 Com

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It

Dave Ramsey S 7 Baby Steps Infographic Money Finance Dave Ramsey Dave Ramsey Plan Ramsey

Construction Accounting Vs Regular Accounting Accounting Bookkeeping Templates Bookkeeping Business

What Families Need To Know About The Ctc In 2022 Clasp

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Credit Card Payment Form A Form To Obtain Authorization To Use A Client Or Purchaser S Credit Card Get It Here Letter Sample Credit Card Payment Lettering

Will Child Tax Credit Payments Be Extended In 2022 Money

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Ends For 36 Million Families Marketplace

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox